work opportunity tax credit questionnaire (wotc)

Is participating in the WOTC program offered by the government. Arizona issued 114 of all WOTC Tax Credits in 2021 SNAP was Arizonas highest tax credit category with 7077 of certifications for that target group.

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

. It asked for SSN plus other personal details that I would prefer not to give to third parties or to companies where Im. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. What is the maximum Work Opportunity Tax Credit available.

The employee groups are those that have had significant barriers to employment. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment.

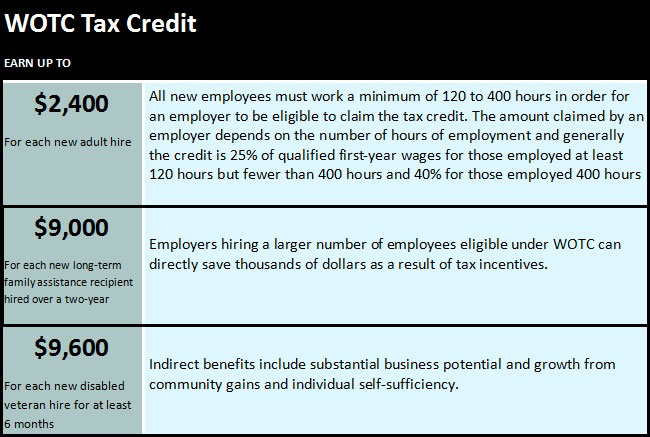

This government program offers participating companies between 2400 9600 per new qualifying hire. This tax credit program has been extended until December 31 2025. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that.

Based upon your responses we will perform a free analysis of your WOTC potential. Should I fill out Work Opportunity Tax Credit WOTC survey even if I know it doesnt apply to me. Work Opportunity Tax Credit WOTC Supplemental NutritionalAssistance Program SNAP recipients Long-termUnemployed 27 weeks Temporary Assistance for Needy Families TANF recipients.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. There are two sets of frequently asked questions for WOTC customers. WOTC is a federal tax credit designed to encourage businesses to hire.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. More Fillable Forms Register and Subscribe Now. Questions and answers about the Work Opportunity Tax Credit program.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Work Opportunity Tax Credit Questionnaire. Work Opportunity Tax Credit Statistics for Arizona In 2021 the state of Arizona issued 23637 Work Opportunity Tax Credit certifications.

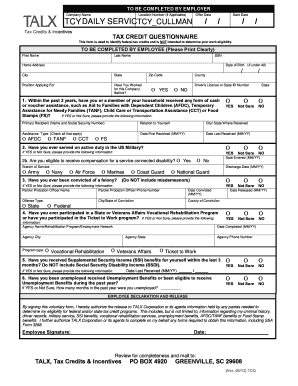

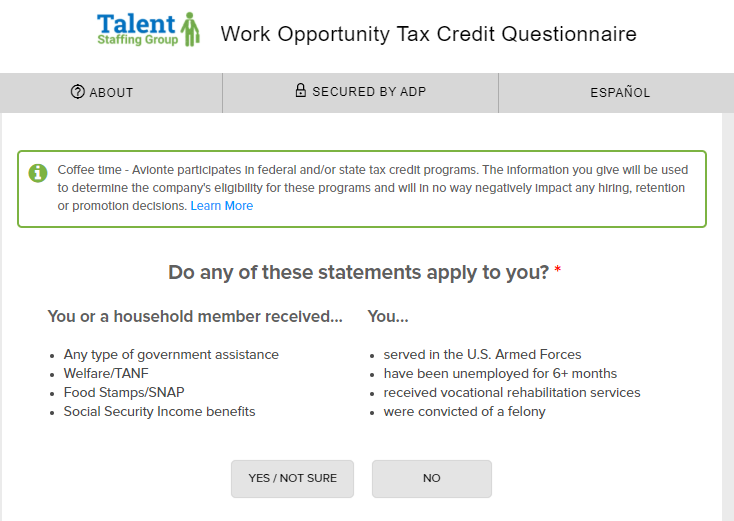

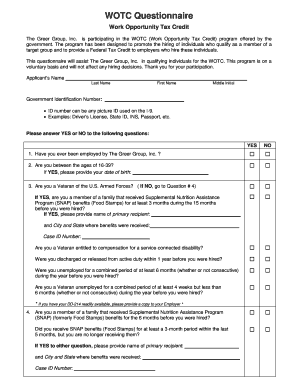

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions.

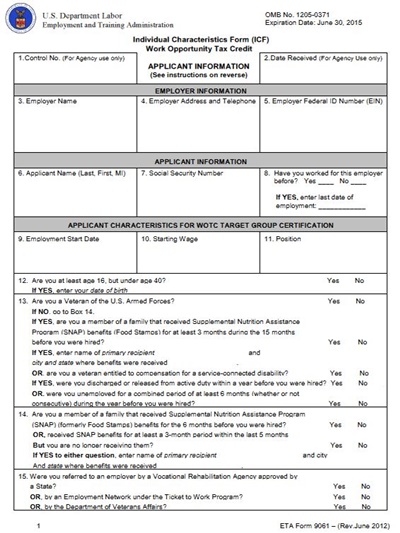

The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. Ad Download Or Email Form WOTC More Fillable Forms Register and Subscribe Now. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL.

And administered by the Internal Revenue Service. Completing Your WOTC Questionnaire. The WOTC is available for wages paid to certain individuals who begin work on or before December 31 2025.

Below you will find the steps to complete the WOTC both ways. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Employers must apply for and receive a certification verifying the new hire is a.

There are two sets of frequently asked questions for WOTC customers. Work Opportunity Tax Credit WOTC Frequently Asked Questions. Please take this opportunity to complete an additional applicant assessment.

The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. Work Opportunity Tax Credit WOTC Subject. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website.

The main objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they earn a steady. WOTC Target Groups include. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service.

CMS Work Opportunity Tax Credit Newsletter April 2022 In this issue. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Completing Your WOTC Questionnaire.

We would like you to know that although this questionnaire is voluntary we encourage you to complete it as it is used to assist members of targeted groups in securing employment. Below you will find the steps to complete the WOTC both ways. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

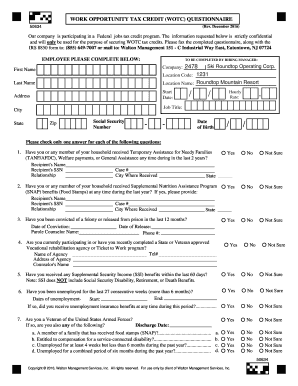

How much of the WOTC youll be eligible to receive when you hire an individual from a target group may vary but the typical amount of tax credit you can receive is between 25 to 40 of the employees wages in the first year of their employment. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. Page one of Form 8850 is the WOTC questionnaire.

Work Opportunity Tax Credit Questionnaire WOTC We are happy to provide the following questionnaire to help determine how beneficial this program could be for your business before you commit the small amount of time and manpower necessary to participate fully. Last Name First Name Middle Initial. Work Opportunity Tax Credit questionnaire.

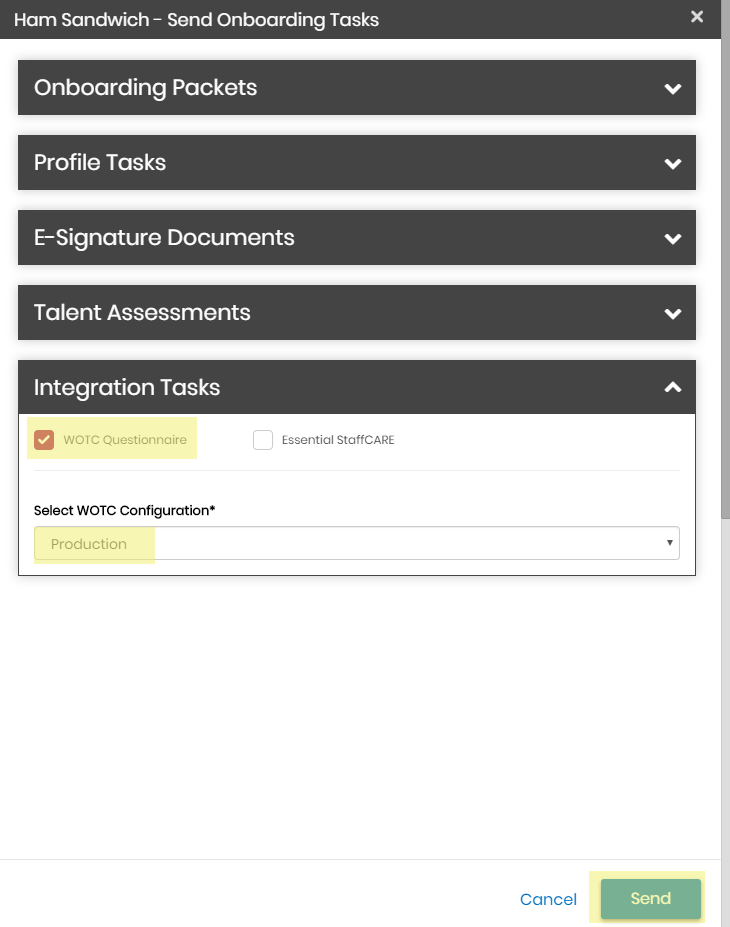

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. What Are the Reasons WOTC Applications Get Denied. Questions and answers about the Work Opportunity Tax Credit program.

CMS Celebrates 25th Anniversary. Work Opportunity Tax Credit Program WOTC WOTC is a Federal tax credit incentive that employers may receive for hiring individuals from certain groups who have consistently faced barriers to employment. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person.

New Military Spouse Bill Could Expand Work Opportunity Tax Credits Target Groups Work Opportunity Tax Credit Statistics 2021 WOTC Wednesday. I was filling out an online job application and then at the end it asked me to fill out an optional WOTC survey. What is the Work Opportunity Tax Credit Questionnaire.

In most instances employers are eligible for 25 of the employees wages if. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

3 Ways To Take Advantage Of The Work Opportunity Tax Credit Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Dol Issues Revised Forms For Work Opportunity Tax Credit Wotc Wotc Planet

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

With Wotc Timing Is Everything Wotc Planet

Retrotax Bamboohr Marketplace Your Favorite Integrated Hr Apps

Wotc Questions How Much Do You Get With Each Category Cost Management Services Work Opportunity Tax Credits Experts

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit Checklist Cost Management Services Work Opportunity Tax Credits Experts

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Completing Your Wotc Questionnaire

Application Workflow Work Opportunity Tax Credit Wotc Avionte Aero